2024 Global Semiconductor Industry Outlook: Trends and Predictions

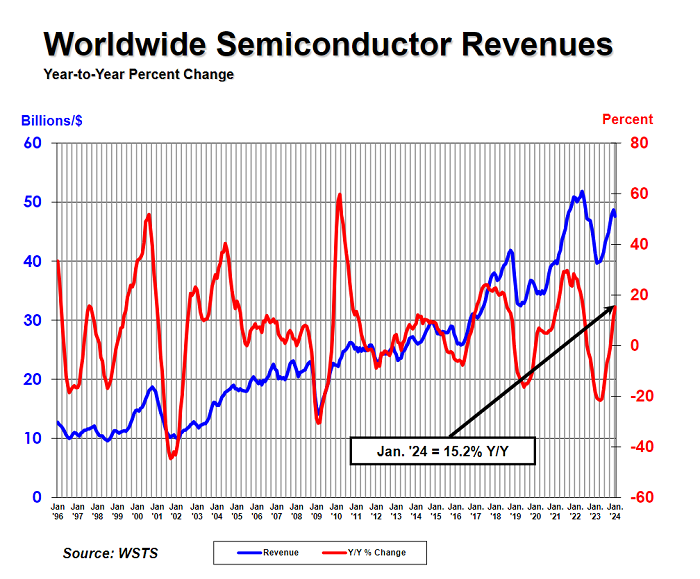

According to the latest data from the Semiconductor Industry Association (SIA), global semiconductor industry sales exhibited a strong growth trend in January 2024, with a year-on-year growth rate reaching a high of 15.2%, totaling $47.6 billion. Although sales decreased slightly by 3.9% compared to December 2023, which stood at $48.7 billion, the overall growth trend remains evident.

Looking at regional sales, monthly sales declined in all regions. The Americas saw a decline of 1.5%, Europe declined by 2.8%, Japan by 3.9%, China by 2.5%, and the Asia Pacific and other regions by 1.4%. However, some regions demonstrated impressive annual sales performance. The Americas achieved a year-on-year sales growth of 20.3%, while China experienced a remarkable growth of 26.6%, and the Asia Pacific and other regions grew by 12.8%. Despite declines in annual sales in Europe and Japan, the overall growth trend of the global semiconductor market remains strong. (Source by World Semiconductor Trade Statistics (WSTS) organization) https://www.wsts.org/

“The global semiconductor market started the new year strong, with worldwide sales increasing year-to-year by the largest percentage since May 2022,” said John Neuffer, SIA president and CEO. “Market growth is projected to continue over the remainder of the year, with annual sales forecast to increase by double-digits in 2024 compared to 2023.”

SIA President and CEO John Neuffer expressed optimism about this situation: "We expect the market to continue growing for the remainder of this year, with annual sales in 2024 poised to achieve double-digit growth compared to 2023." This indicates that the global semiconductor market is experiencing a strong rebound after a period of sluggishness.

In view of this phenomenon, several industry associations and market analysis agencies have made 4 positive predictions of the global semiconductor market rebound in 2024.

1: Market to Experience Cyclical Recovery

According to statistics from the WSTS, the global semiconductor industry grew by 6% year-on-year in the fourth quarter of 2023. Market research Market.us has provided an optimistic outlook for the semiconductor industry over the next decade. The organization believes that the global semiconductor market is poised for significant growth, with 2024 being just the beginning. The total market size for the year is projected to reach $673.1 billion, and from 2023 to 2032, global sales are expected to grow at a compound annual growth rate (CAGR) of 8.8%.

2: Consumer Electronics and Data Centers Driving Market Demand

Recent data from market research Counterpoint shows a 3% year-on-year increase in smartphone shipments, reaching 312 million units in the fourth quarter of 2023, indicating a recovery trend. They predict that global smartphone shipments in 2024 are expected to grow by 3% compared to the previous year. Based on this market demand, 3nm and more advanced processes have become key competitive areas for major foundries.

3: AI Spreading to the Edge Driving Continuous GPU Growth

“AI is rapidly moving towards the edge. This trend, driven by emerging applications such as autonomous driving and automated factories, is shifting focus towards high efficiency, real-time decision-making, and safer and more reliable operations.” Said by Zhao Chuanyu, Vice President of Sales for Analog Devices (ADI) in China. 2024 is seen as the first year of AI PCs, with global AI PC shipments expected to reach approximately 13 million units. Dell'Oro research reports predict a 70% year-on-year increase in GPU output in 2024.

4: Packaging Market to Experience Mixed Results in 2024

The packaging market experienced a downturn in 2023 but is expected to improve in 2024. Zheng Li, CEO of JECT, believes that the recovery of the packaging and testing market is mainly driven by three factors. Firstly, the recovery of consumer electronics and the growth of the storage market are driving forces. With the expansion of data centers and the popularity of cloud computing, the storage market is experiencing significant growth, which will become the "driver" for the recovery of the packaging and testing industry.

Secondly, as chip processes approach physical limits, the semiconductor industry will need packaging and testing technology to enhance performance. This not only push demand for packaging and testing, but also requires diversification of packaging technology.

In a word, despite facing some short-term challenges, the global semiconductor market still holds immense long-term potential. The good market of semiconductor drives the demands of ceramic circuit boards as well.

HOME

HOME